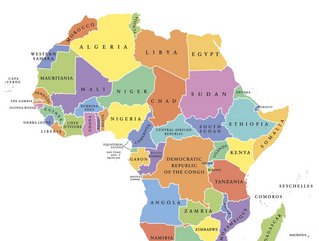

Top 10 issues facing African oil and gas producing countries

As the world looks to accelerate its transition away from fossil fuels, the pressures on the African continent’s oil and gas producing nations are mounting.

McKinsey's recent analysis has found that most are highly exposed to the global energy transition, as their economies depend on oil and gas revenues, while their reserves both cost more to produce and are, on average, more carbon-intensive than oil and gas from other regions.

Here are 10 key issues highlighted in 'The future of African oil and gas: Positioning for the energy transition' report.

10: Optimise fiscal policies and streamline business

National governments could explore optimising their fiscal regimes to improve their resources position on the resource supply curve. For example, Nigeria recently passed the Petroleum Industry Act, which among other provisions introduced a fiscal framework designed to improve the cost competitiveness of the basin.

African oil and gas producing countries could also implement measures to generally improve the ease of doing business, including streamlining the permitting processes and strengthening contract enforcement, which could also help to reduce operating costs.

09: Maximise intra-continent and international gas opportunities

Countries in West and East Africa with significant gas reserves could consider developing cross-border gas pipeline infrastructure to connect to regions where gas will be in significant demand, including countries in North Africa and southern Africa. Alternatively, African countries with significant natural gas demand could invest in coastal LNG regasification plants to allow gas to be imported from other African countries with LNG export capabilities.

08: Invest more in renewable projects

To help secure energy resilience into the future, African oil and gas producing countries should consider investing in renewable-energy projects. Given the high demand for electricity in many African countries, several alternative energy sources such as solar and wind energy have attractive outlooks. Blue and green hydrogen, nascent technologies with unit costs projected to decline, also hold potential for future export to European demand markets.

07: Access available capital pools

Ensuring energy resilience and security in the new energy landscape may require different approaches to financing projects. Investment in renewable energy has increased tenfold in Africa over the past decade, from $5bn from 2000 to 2009 to approximately $55bn in 2010 to 2020 - although approximately 70% was destined for southern and North Africa.

06: Global energy changes from Ukraine war

There is potential for increased demand for natural gas resources from Africa, after the European Commission announced a plan to make Europe independent of Russian fossil fuels before 2030, following the invasion of Ukraine. This demand could potentially be met through investment in gas-export infrastructure such as LNG export terminals or continental gas pipeline projects to deliver African natural gas to European and other global customers.

05: Scale up low carbon infrastructure

Investment in lower-carbon-energy infrastructure projects, especially gas pipelines, processing infrastructure, and liquified petroleum gas (LPG), could enable African countries to promote intraregional trade and boost global exports of African energy products, while also helping to strengthen regional energy access. To ensure bankability, these infrastructure projects would likely need to incorporate decarbonisation or carbon offset levers.

04: Create environment to stimulate renewables investment

Expanding on the low-carbon issue, African governments could consider initiatives to stimulate investment in the decarbonisation of existing operations and in new energy projects while pioneering sustainable energy opportunities in Africa.

Some countries including Kenya, Malawi, and Rwanda have already introduced incentives such as tax holidays, value-added tax exemptions, and import-duty exemptions for renewable-energy businesses to encourage the sector to scale up. Kenya has also announced plans to launch an emissions-trading system that allows companies to buy emissions allowances through a carbon-credit and green-asset registry.

03: Reduce costs of oil and gas production

As global capital pools for hydrocarbon projects begin to reduce, McKinsey's analysis suggests the cost of oil and gas production in Africa is expected to rise, making African oil and gas projects potentially even less competitive in global markets. As oil majors shift toward lower-emission basins, Africa’s oil-producing countries could find themselves deprioritized for further development and facing an increased risk of stranded assets with significant oil and gas reserves remaining untapped.

02: Preparing for tomorrow's energy demand

Over the next two decades, rapid population growth and industrialisation are expected to drive strong energy demand growth across the continent - including for fossil fuels. McKinsey modeling estimates that African energy demand in 2040 could be around 30% higher than it is today, compared with a 10% increase in global energy demand.

At COP26, several new commitments were made, giving further momentum to the transition. In total, more than 150 countries have put forward new or updated emissions targets, with several African countries, including Botswana, the Democratic Republic of the Congo, Egypt, Ghana, Kenya, Morocco, Nigeria, and South Africa, making various commitments to restrict methane emissions, halt and reverse forest loss, phase out coal, and end international financing for fossil fuels.

01: Attract skills and capabilities for the energy future

There is a significant risk of a technical and skills gap if international players continue to divest from the region. African countries could consider increasing and strengthening local oil and gas workforce capabilities while also attracting and investing in the talent, skills, and expertise needed to grow sustainable-energy businesses.

In the short term, stakeholders could look to drive regional content policies to increase local participation across the oil and gas value chain and coordinate global recruitment campaigns to attract the required professionals.

In the longer term, there may be an opportunity to explore the development of regional centers of excellence to share best practices and develop oil and gas knowledge and to create knowledge-transfer mechanisms between international and national partners.

Stakeholders could also invest in partnerships with local universities to develop relevant new curricula to nurture homegrown talent and skills to support the energy transition. It will also be vital to develop programs to reskill and transition oil and gas workers to adjacent opportunities.